Steps to Take Before You File Chapter 13 Bankruptcy

The decision to declare bankruptcy is not an easy one. However, if you've been having creditors call and otherwise contact you non-stop for payment you don't have, bankruptcy may feel…

The decision to declare bankruptcy is not an easy one. However, if you've been having creditors call and otherwise contact you non-stop for payment you don't have, bankruptcy may feel…

Are you planning to file for bankruptcy protection? You have a number of things to accomplish and things to avoid doing before you actually put in your claim for bankruptcy. One of the biggest items on your to do list right now should be preparation of your unfiled tax returns with your bankruptcy attorney advising just when to file these. Why is this so important? Read this blog to learn are a few key reasons to file beforehand.

1. It Will Be Mandatory

Going through financial hard times is stressful, but what’s even more worrying is accepting that you are insolvent. You need to know when to file for bankruptcy to avoid losing your assets. Unfortunately, most people neither assess their financial situation regularly nor make the necessary adjustments until the time is too late. Failure to file for bankruptcy could get you into a deeper problem that could have been avoided.

This guide highlights signs you should file for bankruptcy. Keep reading.

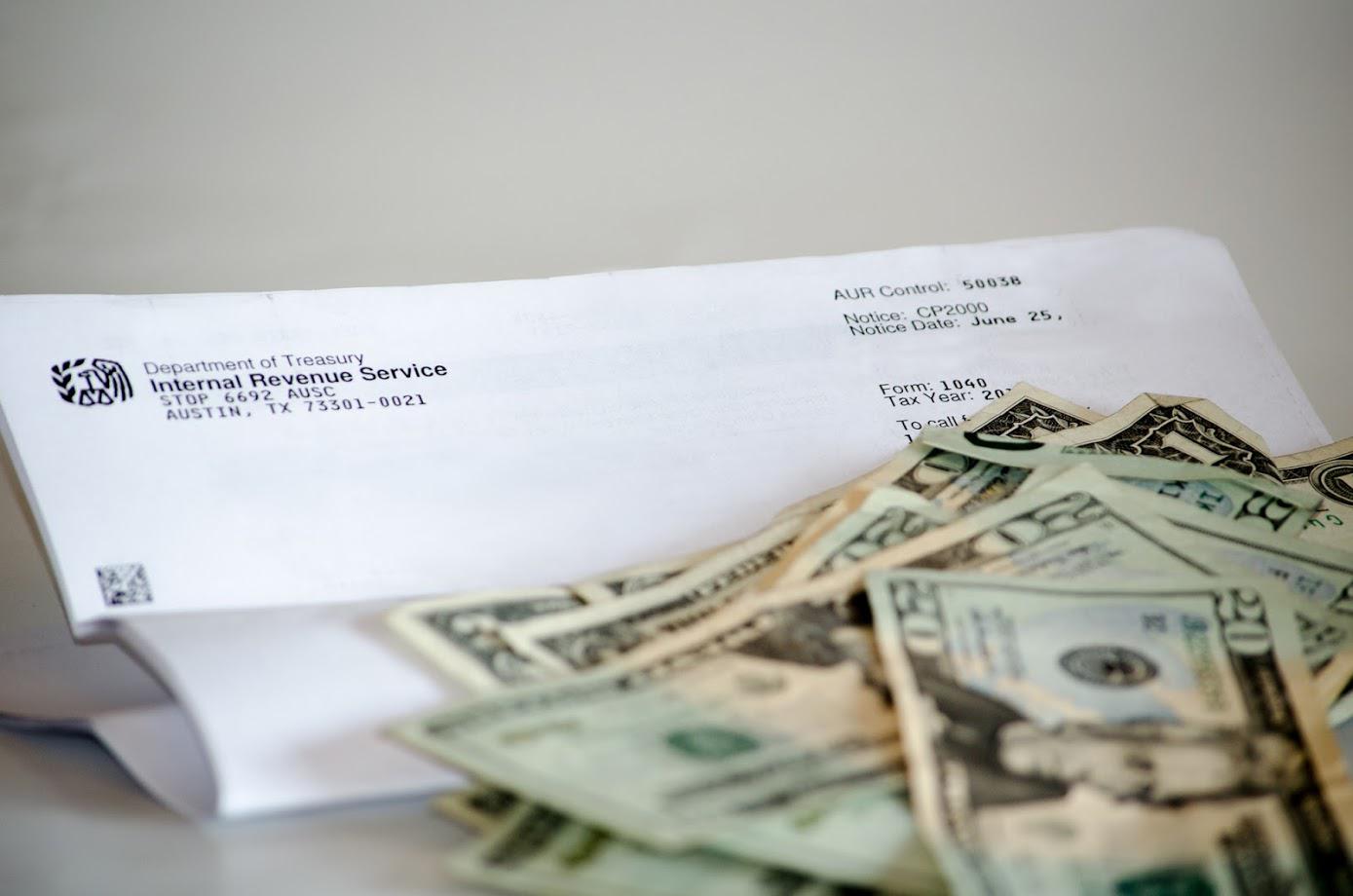

Have you received notice of an IRS examination of your tax returns? While few taxpayers ever get audited by the tax agency, the experience can be very stressful to those who are. You may wonder how you triggered an audit or what you’ve done wrong to cause this to happen.

The truth is that many audits should not be taken as a personal affront to your honesty, your record-keeping, or your math. These types of audits are often triggered by a few key actions that may not even have anything to do with you. Here are four of the most common scenarios that may be out of your control.

If you have previously filed for bankruptcy and you have found yourself in financial trouble for a second time, you may wonder if you are allowed to file for bankruptcy again. The following is some information you should know if you need help with your debt again.

If you need to deal with financial difficulties a second time through bankruptcy, it may be possible to file again. According to the bankruptcy code, you can file for bankruptcy again after a certain amount of time if your prior bankruptcy resulted in a discharge of your debt. If you file before your time limit is passed, you will not receive a discharge again.

By law, if you did not receive a discharge of your debt on your prior bankruptcy, you can file again without a waiting period.

Have you discovered during a divorce that your spouse has been committing tax fraud while you were married? Unfortunately, this now puts you in a tricky spot. You need to look after your own interest first and foremost. Those interests, though, can be confusing and may represent multiple challenges.

To help you determine what to do with this new information, consider these unexpected side effects before making any moves.

For many people, knowing about a fraudulent activity makes them feel morally bound to tell an authority — even if your own taxes were involved. If you feel this way, the best thing you can do is to work with a qualified tax attorney to determine the best way to go about it. The IRS and state tax agencies will generally consider your good faith efforts to be honest and forthcoming, but they are not obligated to.